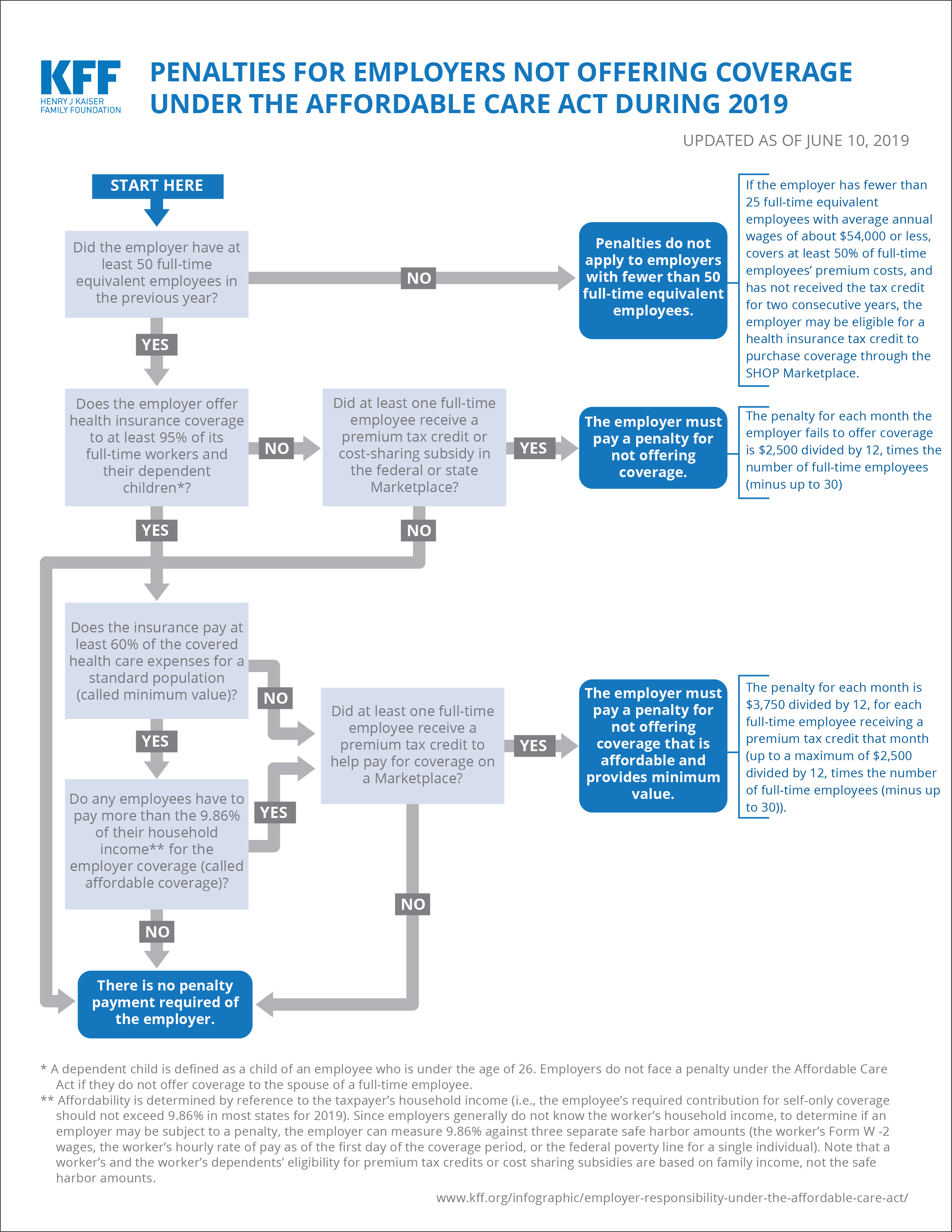

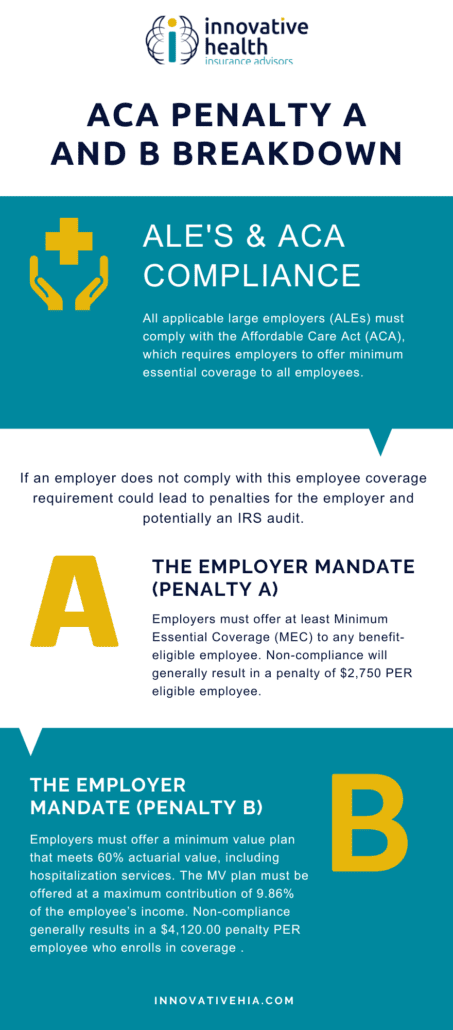

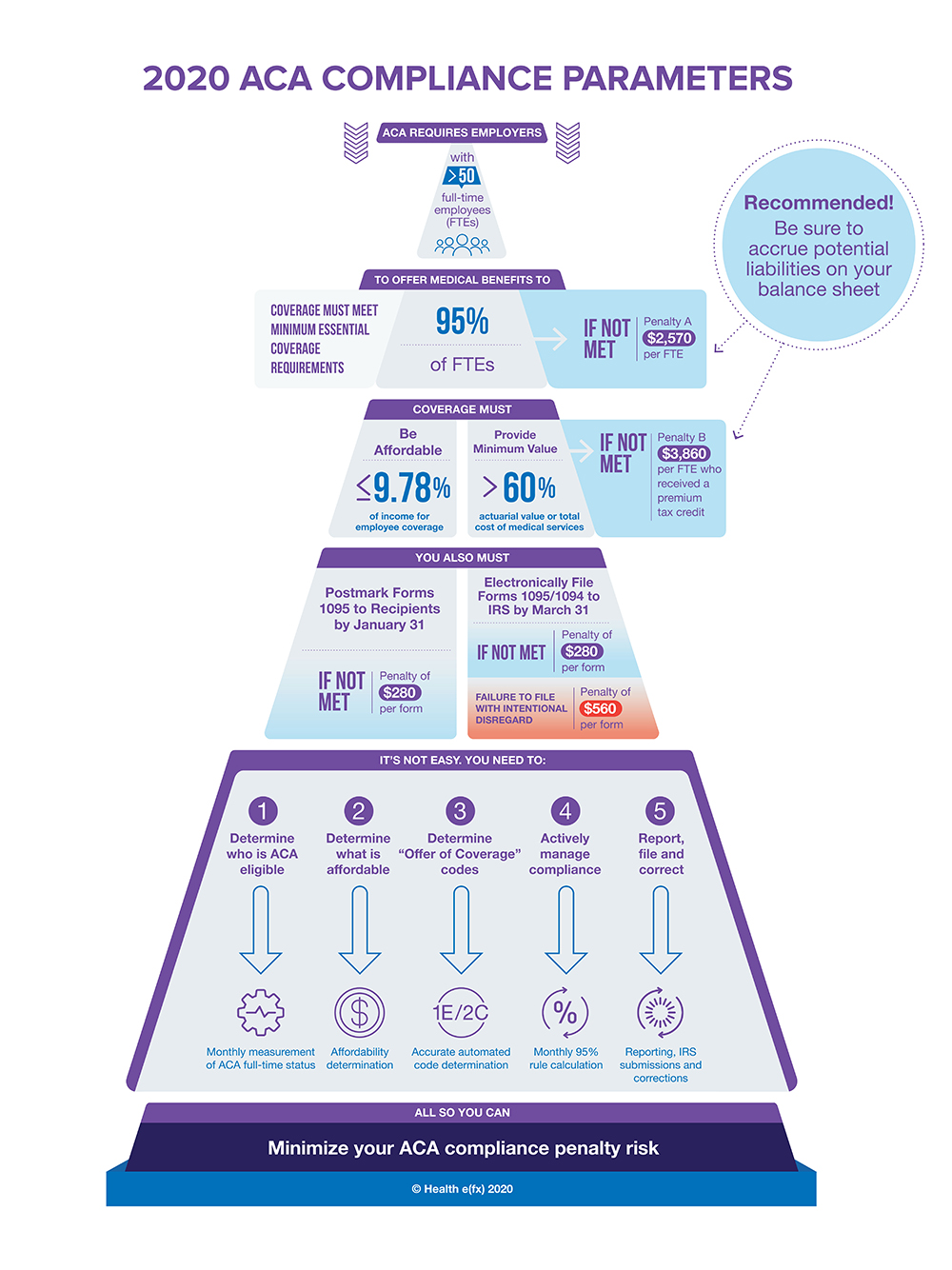

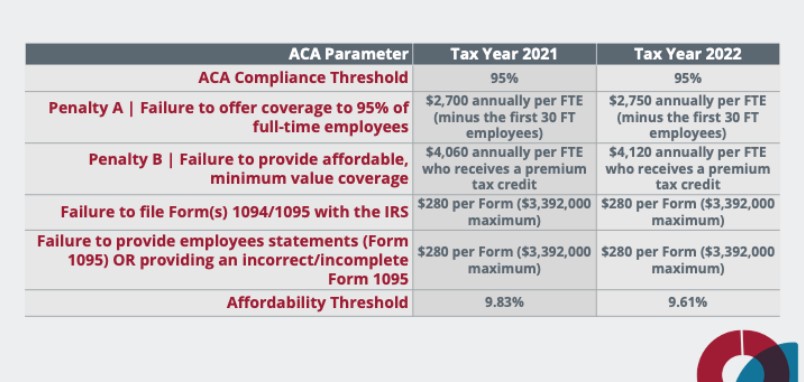

The IRS announced that employer-sponsored health coverage will satisfy the Affordable Care Act (ACA) affordability requirements

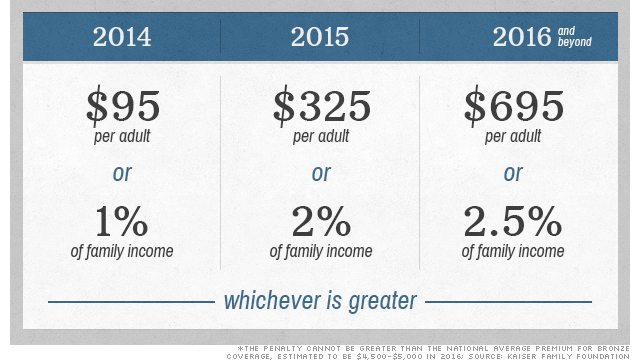

House of Representatives ACA Repeal and Replace Legislation Could Increase Penalties for Failure to Buy Insurance